Week Ending July 11, 2025

BEEF

The market is steady to weaker. Total beef production for last week was down 15.4% versus the prior week and down 7.1% compared to the same week last year. Year to date, total production is down 3.4% compared to the same period last year. The total headcount for last week was 474,000, as compared to 521,000 for the same week last year. Year to date, the total headcount is 15.05 million head, which is down 6.5% from last year. Live weights for last week were down 3 lbs. versus the prior week and are up 30 lbs. from the same week last year. Trading on live cattle continues to be mixed. August futures traded slightly lower, but December contracts were on the rise. Over the last month, live futures have been showing vibrant strength followed by profit taking due to overbought signals. Beef production was down significantly last week due to plant holidays across the industry. As a result of the reduced production hours, supply is extremely tight this week with many shortages being reported. Consumer demand is down compared to previous years, but the reduction in supply is keeping things in balance. Retail and distributive buyers are taking a conservative posture on future purchases in case the market adjusts. Carcass cutout values inched lower over the last week with some soft undertones being reported. End cuts are experiencing market weakness. Middle meats are trading at the lower end of established ranges due to inventory adjustments after the holiday. With the high costs of beef, the spread between choice and select grades remains tight. Trade values on a category-by-category basis have become a bit unpredictable following the holiday.

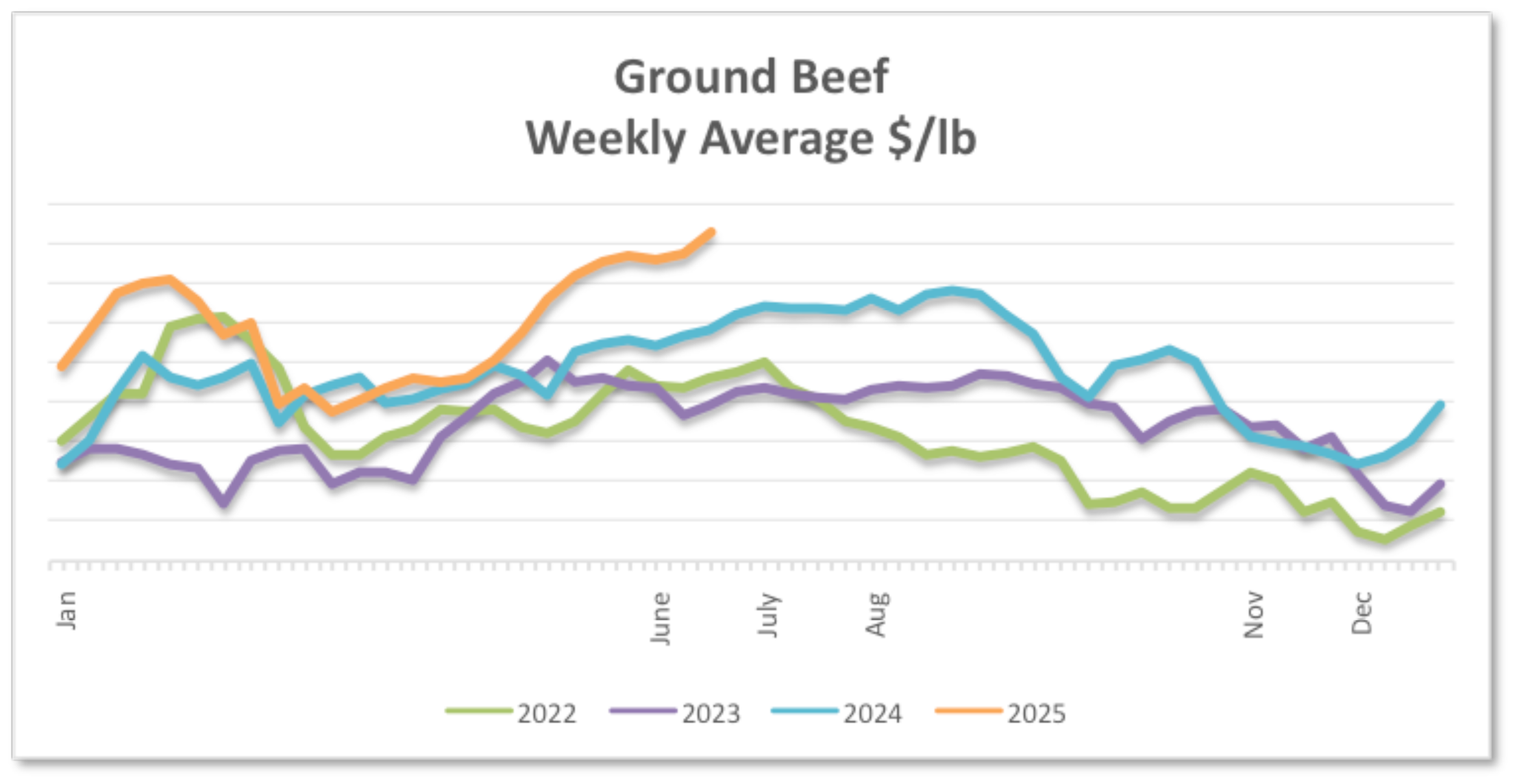

Grinds – The market is steady. Seasonal demand is vibrant, and grinds remain a cost-efficient product for consumers. The supply side remains tight. Imported trim from Australia and Brazil is still needed to fill the void. Trade levels on 73% and 81% grinds have flat lined for the time being.

Loins – The market is weaker. The retail and food service volume has slowed due to post-holiday demand patterns. With holiday features completed and packers showing some inventory, the category has soft overtones. Supply is showing up on the spot market and varies by packer. Market levels have been pressured lower over the last week.

Rounds – The market is steady to weaker. Grinding operations have been using more rounds due to lack of trim but that trend is starting to subside. Availability varies by packer and producing plant. Market values are being pressured lower.

Chucks – The market is steady to weaker. The retail business has become sluggish, and volume is soft. Grinding operations have helped with demand but that is showing signs of becoming static. Supply varies by packer and sourcing facility. Trade levels have been pressured lower on the open market.

Ribs – The market is steady to weaker. With holiday retail features completed, post-holiday demand is showing some signs of weakness. Supply is becoming more available. Trade levels have been declining over the last week.

PORK

The market is steady to weaker. Total pork production for last week was down 23.5% versus the prior week and down 7.5% compared to the same week last year. The total headcount for last week was 1,846,000 compared to 2,019,000 for the same week last year. Live weights for last week were down 1 lb. compared to the prior week and up 5 lbs. versus the same week last year. Summer demand is reported to be good but post-holiday demand patterns are starting to take effect. Following the holiday, demand has slowed down but retailers are still using pork as a key component of their weekly features. Tariffs continue to have industry participants concerned but limited information is being reported about any actual effects. At the current time, approximately 25% of U.S. production goes to the export channel. Lean hog futures hit a one-month floor and then rebounded with strength to settle higher across the board. Current futures remain unsettled as many contracts are teetering in overbought territory. Market values on loins, butts, and ribs are trading at the lower end of established ranges at the current time.

Bellies – The market is steady to weaker. Demand from retail and food service is active but appears to be slowing down. Frozen stocks are reported to be at the lowest level in about two years. Fresh supply is becoming more available. Trade levels have been experiencing downward pressure over the last week.

Hams – The market is steady to weaker. Domestic demand for bone-in hams remains sluggish and export business to Mexico is unpredictable. Boneless hams are getting adequate support from the retail deli channel. Supply is available. Market levels are being pressured lower.

Loins – The market is steady to weaker. Overall demand for bone-in loins is starting to subside as we enter the back half of summer. Boneless demand is moderate at best following the July 4th holiday. Supply is available. The market on bone-in product and boneless loins has soft undertones.

Butts – The market is steady. Domestic demand is holding strong due to adequate retail business. Export demand with Mexico and the Pacific Rim is fair at best. Supply is available but still tight. Trade levels are holding even but have weak undertones.

Ribs – The market is steady. Retail and food service demand has held up better than expected following the holiday. Supply varies by packer and plant. The markets on spareribs, St. Louis Ribs, and back ribs are mostly flat.

CHICKEN

The market is steady. The total headcount for the week ending 7/5/2025 was 143,571,000 as compared to 142,583,000 for the same week last year. The average weight for last week was 6.44 lbs. as compared to 6.36 lbs. for the same week last year. Following the holiday, demand patterns are moderate and have become a bit more consistent than in past weeks. Spot trading on boneless breast meat has picked up and is supporting current market conditions. Spot loads of tenderloins and wings continue to catch a premium when offered. Export demand for leg quarters and whole legs is reported to be status quo at the current time. Trading partners are now taking a cautious approach as supply continues to improve. Slaughter numbers have picked up recently and that is starting to affect trading values in multiple categories. With supply on the rise, there appears to be more inventory available for spot business and feature activity. Hatchability has finally risen above 2024 levels but is still below the 5-year average. Over the past week, market levels have gone from soft to holding steady.

WOGS – The market is steady to weaker. Retail deli and QSR business is moderate to good following the holidays. Supply has become more available on premium and cutting stock WOGS. Following the holiday, market levels have soft undertones.

Tenders – The market is steady. Robust demand from the fast-food channel is the main driver of the category. Custom portioning to support the food service channel remains strong. Supply is limited. The market on select and jumbo sizes is moving sideways.

Boneless Breast – The market is steady. Demand from the retail and food service channels is moderate to good. Improved demand for CVP product has helped to stabilize the category. Overall supply has tightened over the last two weeks. The market on all sizes is holding even at the current time.

Leg Quarters and Thighs – The market is mixed. Domestic demand for drums and thighs is vibrant in combination with the grilling season. Export business on whole legs is a full steady. Supply on thigh meat is showing some excess while bone-in parts continue to be tight. Market on thigh meat is being pressured lower while bone-in drums are holding firm.

Wings – The market is steady to firmer. Demand from the foodservice channel has picked up in recent weeks. Further processors are starting to replenish inventories. Supply has tightened over the last month. The market is being pressured higher on jumbo and medium wings.

TURKEYThe market is steady to firmer. The total headcount for the week ending 7/5/2025 was 3,123,000 as compared to 2,459,000 for the same week last year. The average weight for last week was 30.75 lbs. as compared to 33.45 lbs. for the same week last year. Demand patterns, both domestic and export, are moderate to good. Whole birds, back-half parts, and boneless breasts continue to be highly sought after with limited supply being shown. Due to the respiratory virus reported earlier this year, bird weights are lower than expected and the overall supply is being squeezed. Slaughter data shows the number of turkeys processed year to date is down about 6% from last year. With recent news of plant closures, additional supply is not on the horizon anytime soon. Due to limited supply, asking prices are on the rise for boneless breast, drums, and wings. Market levels across all categories are trading at the high end of established ranges.

Whole Birds – The market is steady to firmer. Very few spot transactions being reported. Due to tight supply and bird weight issues, existing orders are getting cut on a percentage basis. Product availability is hard to find. Most suppliers are communicating that they are sold out until further notice. Market levels on spot loads are catching a premium.

Breast Meat – The market is steady to firmer. Seasonal demand from the retail deli and QSR channels is moderate to very good. Fresh and frozen supply is scarce on the spot market. Market levels continue to inch higher on the outside market.

Wings – The market is steady. Export business on whole wings is fair. Domestic volume on two-joint wings is adequate. Supply is tight due to limited slaughter statistics. The market is flat on Tom-sized wings.

Drums and Thigh Meat – The market is steady. Export demand for drums remains stable. Domestic demand for thigh meat has balanced out over the last month. Supply is tight on parts and thigh meat. The market is holding even on drums and thigh meat.

SEAFOOD

White Shrimp – The market is weaker. Supplies are adequate to fully adequate with moderate demand.

Black Tiger Shrimp – The market is firmer. Demand is moderate to good and pricing levels are firmer. Availability is tight on the premium sizes.

Gulf Shrimp – The market is steady to firmer. Supplies are barely adequate to adequate while maintaining a firm undertone.

North American Lobster Tails – The market is mixed. The current market for small to mid-size tails and meat products remained stable, likely supported by renewed demand. In contrast, larger tails face ongoing challenges, with additional discounts reflecting continued buyer preference for smaller sizes.

Salmon – The market is unsettled. Farmed salmon is unsettled with pricing influenced by sellers’ supply positions. There are reports of offers above and below the current range. The West Coast whole fish market is steady to weaker. Supplies are fully adequate with quiet demand. Europe is reporting an unsettled market. Norway is reporting a firm market with adequate to barely adequate supply amidst moderate demand. Scotland is reporting a weaker market with reports of offers above and below the range. The Chilean whole fish market is weaker. Supplies are adequate to fully adequate with quiet to fair demand.

Cod – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Flounder – The market is steady and mostly unchanged.

Haddock – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Pollock – The market is firmer. Supplies are adequate with moderate demand.

Tilapia – The market is unsettled. There are reports of slow demand, which has the potential to create long inventory positions.

Swai – The market is steady to firmer.

DAIRY

CHEESE

The market is mixed. Both the CME Block & Barrel markets were mixed as the week progressed. The CME Block market trended weaker than the prior week. The CME Barrel market trended slightly firmer than the prior week. Cheese production schedules are reported to be mostly steady. In the East, milk is meeting production and manufacturing needs. In some areas of the region, spot milk availability is tighter. In the Central region, high summer temperatures are contributing to lighter milk outputs. Some cheesemakers in the region are resorting to the spot market to secure volumes of milk to keep production paces steady. Cheese production in the region is steady to lighter. Cheese curd sales are strong. In the West, milk handlers note demand for Class III milk is strong from cheesemakers. Cheese production in the region is mostly steady. Some cheese manufacturers report that spot milk availability is not plentiful enough to keep production schedules at full capacity. Demand for retail cheese is steady. Foodservice demand for cheese remains light. Domestic demand varies from steady to stronger. Stakeholders note prices for US cheese is competitive against internationally produced cheeses. Export demand is stronger.

European milk production is decreasing week-to-week. Milk production in Europe is up 1.2% year over year according to April data metrics. In Hungary and Slovakia, confirmed cases of Foot and Mouth disease have been reported, noting the first outbreaks in those countries in over 50 years. In late June, France’s Ministry of Agriculture and Food Sovereignty confirmed cases of lumpy skin disease in a herd located in the Savoie area of France. While the disease is not transmissible to humans, proper protocols are being implemented to mitigate any spread to other herds. European cheese production varies from steady to lighter. Production is reported to be keeping up with demand. Demand for foreign type cheese is strong from both the retail and food service sectors. Southern and Eastern European demand is stronger. Demand from international buyers is steady. Market tones in Europe are steady to bullish.

BUTTER

The market is mixed. The butter market was mixed as the week progressed and trended slightly firmer than the prior week. As seasonal temperatures heat up across the nation, milk outputs are declining. Cream volumes are beginning to tighten in most regions. Butter manufacturers across the country note that they are receiving cream at a pace that is meeting manufacturing needs. Butter production schedules vary from steady to lighter after the holiday last week. In the East, cream volumes are ample for butter makers and production schedules are mostly steady. In the Central region, milk output is declining. Recent unplanned downtime in the region has allowed cream to be plentiful for manufacturing. In the West, butter makers convey they are receiving contractual cream volumes. Increasing temperatures in the region are negatively impacting cream volumes and reducing the availability of spot loads. Cream demand is strong across the nation as ice cream manufacturers and butter makers pull on available volumes. Spot loads of butter are generally available for purchasing. Many butter makers convey they are freezing loads of butter for later use this year. Domestic butter demand is steady. Demand from international buyers for US butter is strong. Stakeholders note prices for US butter remain competitive against butter produced internationally. Export sales are strong.

EGGS

The market is mixed. Retail demand has picked up recently as shelf prices have become more attractive to consumers. While sustained summer heat is dampening activity in some areas, others are seeing modest gains driven by lower shelf prices and retail promotions. The uptick reflects increased foot traffic as shoppers take advantage of perceived value in the retail channel. Food service demand is moderate across the country with some key travel destinations performing well. Distributors in these areas are buying selectively, willing to commit when pricing is favorable but maintaining a cautious approach to inventory.

Market levels are moving lower on medium sizes and moving higher on large sizes. National weekly reports show shell egg inventory up 3.7% and breaking stock inventory down 0.1% over last week.

Demand in the egg products category is moderate to slow following the holiday. Liquid whites are being sourced below quoted levels on the open market. Liquid yolks have been steady since the month of May but are now showing some weakness in the spot market. In the dried market, demand for yolks and whites is soft and the market has weak undertones.

FLUID MILK

The market is weaker. Milk production across the country is lighter. Stakeholders note higher summer temperatures are contributing to decreased milk outputs. Approximately 21% of the milk cow inventory nationally is within an area experiencing drought, according to the USDA Commodities in Drought monitor. In the Northeast, cow comfort and milk outputs have decreased as the temperatures have risen. In the Southeast, milk production is declining. Some manufacturers in the region are buying spot volumes to bridge the gap caused by lighter milk outputs to maintain steady production schedules. In the Central region, declining milk outputs are also attributed to the summer heat. In California, milk production is seasonally lighter. According to contacts, week-over-week milk production throughout June 2025 was mixed. Handlers have noted that June 2025 outputs were higher than at this point last year. Cream availability in the region is mixed. Farm level outputs in the Pacific Northwest vary from steady to lighter. Cooler temperatures in this region were noted in the second half of June, which supported greater milk outputs.

All Class demands are steady. Class I demand is seasonally light and expected to remain light through the end of July. Class II demand is strong as ice cream makers pull on available milk volumes to meet production needs. Ice cream and butter manufacturers continue to use available cream volumes to run busy production schedules. Downtime was reported due to the holiday last week at cheese plants across the nation, thus contributing to increased Class III availability in the market. Class IV demand is strong though slightly down from the prior week. Though milk components are declining, the recent holiday has left more cream available for spot purchasing. Condensed skim milk demand is steady while availability is looser.

OIL

Soy Oil – The Market is mixed. Lack of demand for US soybeans on the global market and positive weather forecasts have weighed on soybean complex prices throughout the week. CME soybean oil has tracked down with contracts close to unchanged. Oil share remains at 50% which could be providing some resistance for bean oil prices to increase rally without another policy input and the main resistance seems to be the uncertainty surrounding trade with the US. CME August soybean oil ended down 1.52%. While soybeans and soybean oil fade with uncertainty in trade agreements and positive weather outlooks, meal remained relatively steady. The US has still seen no soybean/meal buying from China which could begin to put more pressure on the August contracts. Crush margins are still strong, leading facilities to run near full capacity.

Canola Oil – The Canola seed market is mixed. Stats Can updated 2025 acreage expectations with farmers reporting 21.5M acres, down 2.5% from last year. The Canola crop is planted and in generally good shape. The crop ultimately depends on how the weather turns in July, though as of now it looks to be in decent shape. Markets are still concerned about the condition of the current weather for the growing areas for current crops.

Palm Oil – The market is strengthening. Malaysia has released palm oil stocks numbers and its surprised upside. The MPOB data was released this week show production was down 4.5%, coming in at the low end of trade estimates. Ending stocks were up 2% and slightly higher than trade guesses. The session was a bit volatile with initial weakness following CME soybean oil, and then lower prices after the report release. India continues to buy, adding overall support to the market. The lack of exports has led to a higher total than anticipated. Palm exports fell over 10% for last month while the domestic consumption in Malaysia increased by over 40%.

COCOA

The cocoa market is unsettled. Supply issues for cocoa have been exacerbated by long lasting structural problems within the industry. Price increases on cocoa and any products produced with cocoa should be expected throughout the year.

COCONUT

The coconut market is unsettled. Cost increases have continued beyond expectations and are now at record highs. This is due to climate conditions, soaring demand and reduced production capacity. Climate patterns from El Niño and La Niña have impacted growing and harvesting conditions. Surging demands from other countries, notably China, has contributed to deficiencies in the market. According to the United Coconut Association of the Philippines, there have been government initiatives in conjunction with the Philippine Coconut Authority to address rising demand and costs in the market. Price increases on coconuts and any products produced using coconuts should be expected throughout the year.

COFFEE

The coffee market is mixed. According to the USDA’s Foreign Agriculture Service, projection for world coffee production is expected to increase when compared to year-over-year outputs. In Brazil, the coffee harvest is underway and expected to weigh on current coffee prices. As of the past week, the coffee harvest is 24% complete compared to 34% complete as of this time last year. A secondary harvest of Robusta coffee is underway in Vietnam. According to the USDA’s most recent report, the forecast for Brazil’s coffee production rose by .5% year-over-year. In Vietnam, the coffee output projections rose by 6.9% year-over-year. The outlook for abundant coffee supplies is beginning to undercut prices.

HONEY

The honey market is unsettled. Demand for organic honey continues to grow while only three countries, Brazil, Uruguay and India, supply over 95% of organic honey product. Between 30-40% of organic honey is consumed by the retail channel. Brazil has increased their supply to meet demand. Supply tightness is being reported from Uruguay thus supporting reduced imports year to date. The honey industry continues to react to anti-dumping activity as well as tariff fluctuations. Price increases on organic honey should be expected throughout the year.

IMPORTED PEACHES

Canned peach processing is due to resume in key European hubs Greece and Spain, while in China it is already in full swing.

Greece – Cling peach harvesting in Greece is projected to resume in July. Raw material projections for the season are around 30% lower than forecast of fruit suitable for processing (canned, purée and IQF), according to the Greek Canners’ Association (E.K.E). The crop reduction this year is projected to offset carry-over since there is still surplus of unsold stocks of product from the previous season that is projected to be cleared in Q4 2025.

Spain – Peach processing of the Pavia variety in Spain is projected to resume in the second week of July. The Spanish crop projection for the season is down 5% year over year. It is yet to be determined the final amount that will be destined for fruit raw material for canning.

The industry projects peach demand from the fresh fruit market, which remained strong during June, to start softening by late June.

China – The Chinese peach harvest for canning resumed in the first half of June, slightly earlier than usual to allow processing in a timely manner to satisfy some immediate needs of the domestic baking industry. A hailstorm in the second week of June severely impacted crops in the Anhui province, where around 20% of the expected peach output was lost. Updates to the Chinese crop reports are expected to update in late July.

SPICES

Dried Garlic – US garlic acreage for the 2025 crop is down 7-10% compared to 2024. Additionally, crop emergence has slowed due to recent weather variability, potentially delaying harvest by one-to-two weeks. Central and Southern CA crops have matured with water cut completely. Arizona received 2–4 inches of rain in early June. There is potential yield risk. Current garlic inventories are sufficient to meet regular domestic demand for most fractions except granulated, which have been in exceedingly high demand due to a slowdown in offshore supplies.

Like the US onion market, US garlic growers face rising costs for labor, water, and other inputs, which are reflected in current market pricing. Tighter supplies are anticipated for minced and granulated. However, the availability of powder, ground, and other non-restricted granulated garlic is expected to be adequate.

Dried Onion – US onion acreage for dehydration is down 15-20% compared to 2024. This reduction is due to higher-than-normal carry-in inventories at the beginning of the year, stable demand, and increased carrying costs. Early California harvests experienced weather variability, leading to a two-to-three-week delay. The onion crop harvest began around mid-June 2025. Initial yield reports from California indicated a 3-5% yield decline, particularly in the Central Valley region due to unseasonal rains and potential onset of foliar disease. It’s too early for a definitive crop prediction, but this trend merits monitoring.

In this inflationary environment, growers face rising costs for labor (4-6% increase), fuel, freight, and utilities (3-5% increase). Tighter supplies are expected for piece fractions, especially large chopped, chopped, and blends. The availability of powder and minced onions is expected to be adequate to meet normal demand.

SUGAR

Domestic Cane Sugar – The market is mixed. According to the June World Agricultural Supply and Demand Estimates report, Cane sugar production is projected at 9.254 million STRV, a 30.889 STRV decrease in production from last month. Projections are based on modest acreage growth in Louisiana and stable acreage in Florida.

Domestic Beet Sugar – June WASDE indicates production at 5.150 million STRV is reduced 29,750 from last month on a small decrease in projected sugar beet yield.

Mexico’s sugar projections are the same as last month at 5.094 MT. Production has yet to recover fully from the effects of severe drought from two seasons ago.

WHEAT

The wheat market is mixed. The winter wheat harvest is nearly 37% complete. US spring wheat was rated at 53% good or excellent compared to this time last year. The outlook for US wheat in the upcoming year is for slightly larger supplies, unchanged domestic use, higher exports, and lower ending stocks. Soft Red Winter and White Winter production is offset by lower Hard Red Winter wheat production. According to the June World Agricultural Supply and Demand Estimates report, the global wheat outlook is for reduced supplies, higher consumption, higher trade, and lower ending stocks. Supplies are projected to be down on reduced beginning stocks for Russia which is offsetting higher production from the EU and India. Global consumption has been raised mainly on higher food, seed and industrial use in Nigeria, Sudan, and India. Annual projected global stocks have been lowered on reductions for Russia, the United States, Iraq, and Turkey.

**Graphs represent data for the week ending July 4 2025**